Financial literacy and the American worker.

explore the report

Introduction

This study takes a look at what American workers believe and how they behave when it comes to money management.

More Than a Paycheck

Getting paid isn’t the only thing employees look to employers for. They're looking for advice on what to do with their money.

Not every employee feels financially literate.

I find it difficult to make money decisions

I'm very confident about how I manage my money

I'm not afraid to take risks with money

Financial literacy — what is it?

It’s the ability to know how to manage one’s financial resources effectively for a lifetime of financial security. It includes knowing how to make informed decisions around things like

Investing

College Tuition

Insurance

Retirement

Taxes

Budgeting

Real Estate

And the lack of financial education is keeping employees up at night

Of workers are kept up at night by concerns about having money to pay their bills

Don't save because they are focused on paying off debt

Want to manage their money better, but can't afford to do so after factoring in bills and debt

In order for employers to help, they need to understand the unique points of view and financial education needs of their employees.

Take the quiz6 Key Financial Personalities

How to Help

Five key ways employers can help

Show Concern

70% of employers feel compelled to help employees better manage their personal finances. Help new hires fully understand payroll processes, schedules and potential investment options, and continue to check in with them throughout their tenure.

Share the Knowledge

Offer resources that empower employees to make smarter money decisions. Try periodic in-office trainings or seminars, print and digital materials across a range of financial topics, and solicit questions and feedback from colleagues to gauge and cater to topics of interest.

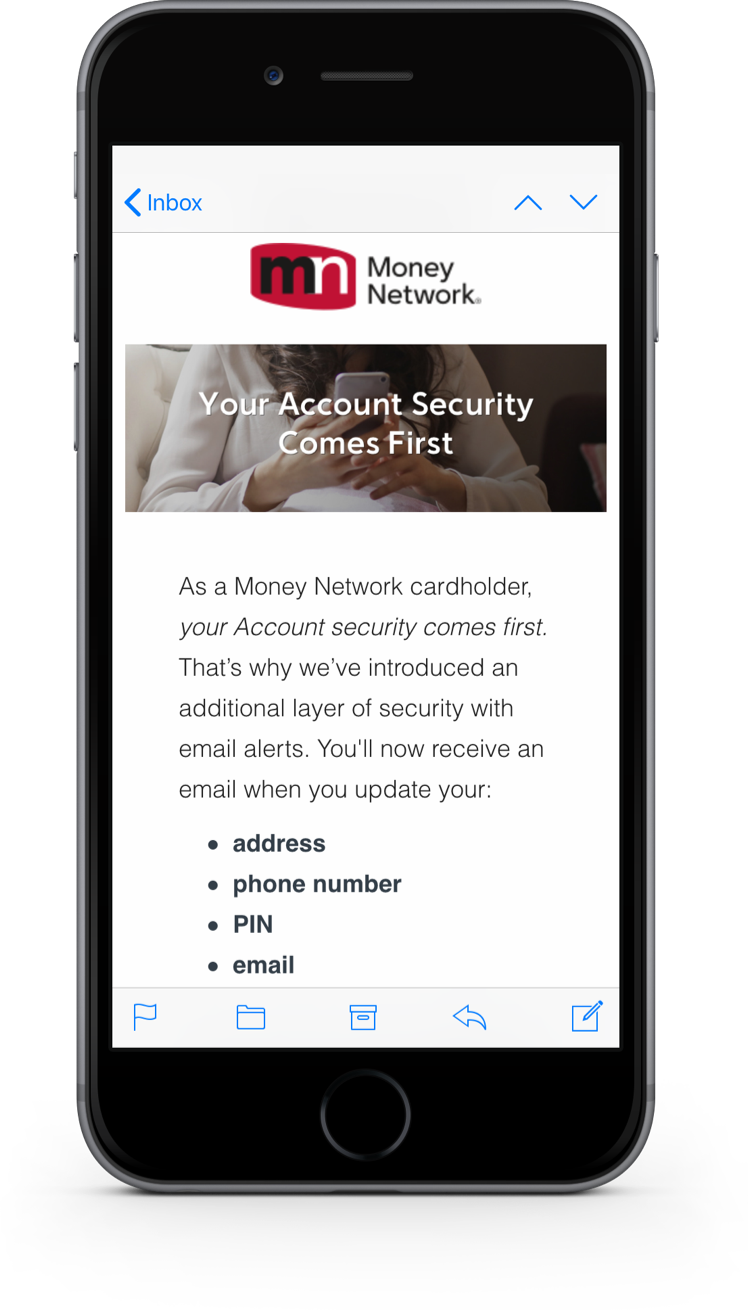

Navigate the Pitfalls

Help workers learn how to distinguish legitimate communications from potentially fraudulent ones. Offer reminders of basics such as how to protect account information.

Employees who consider themselves financially illiterate are more likely to fall into traps and become susceptible to identity theft or financial fraud.

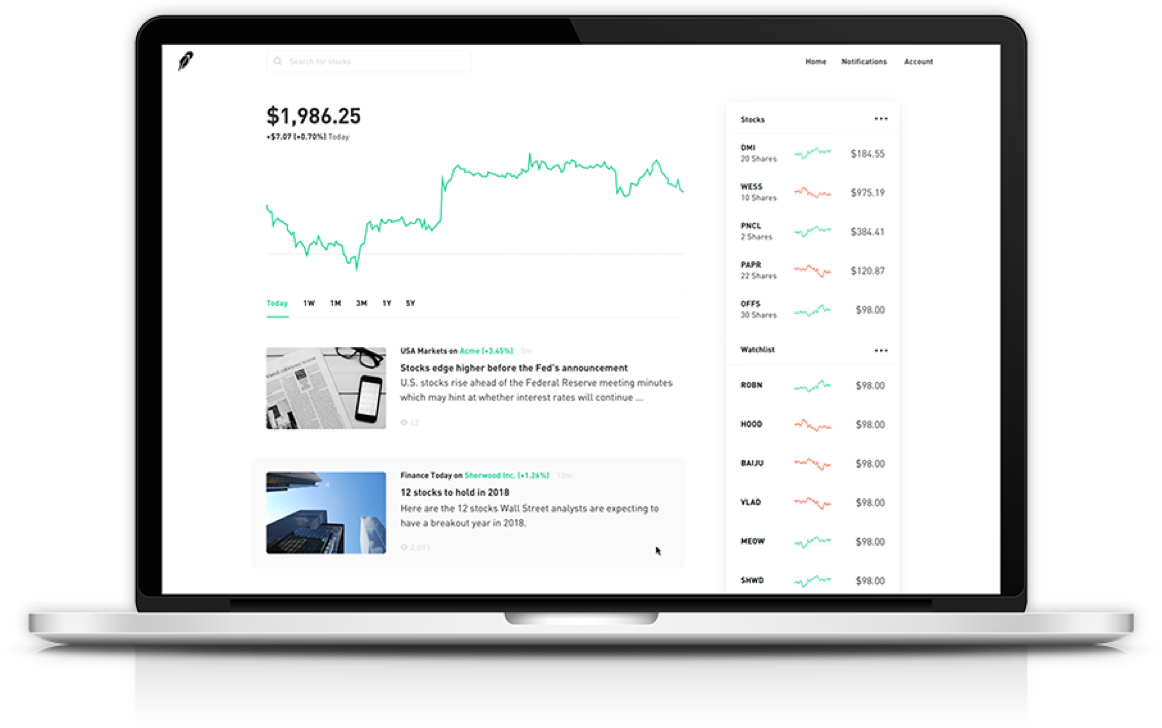

Simplify and Streamline

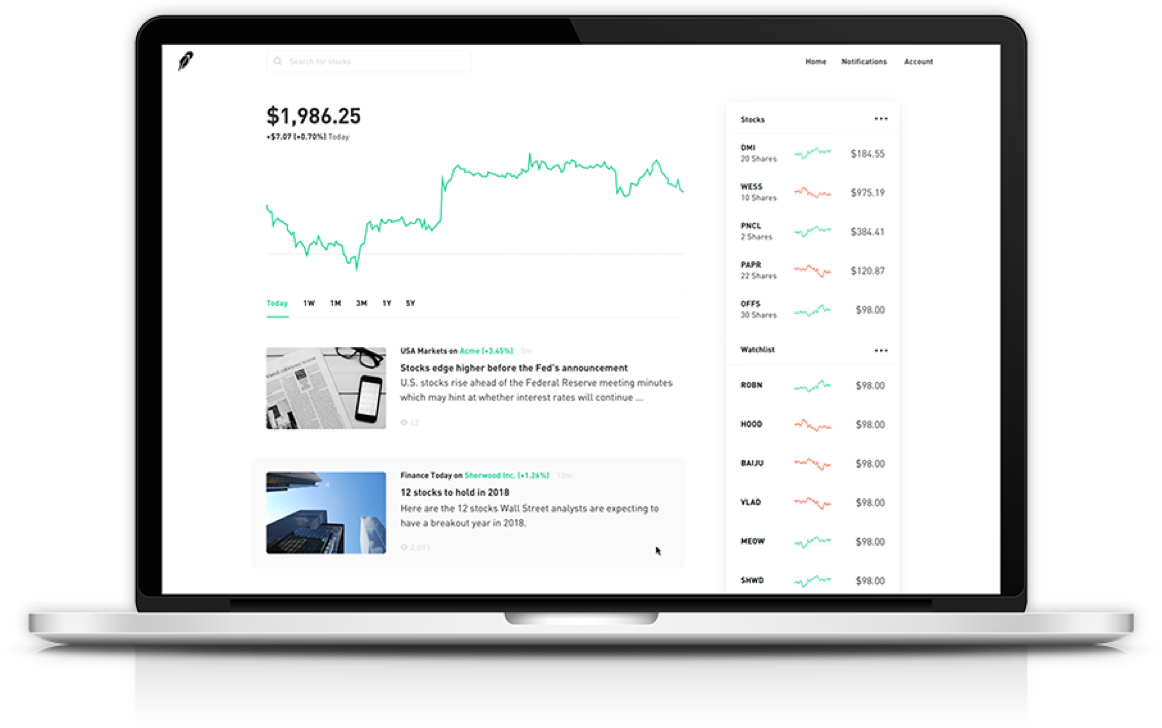

Grow employee financial confidence by providing a single, turnkey platform that offers complete visibility into their accounts and investments. Move to consolidate money management tools and prevent the lost time, questions, and headaches that come with the use of multiple systems or applications.

Expand Payroll Options

Use payroll cards to enable employees to feel more secure and confident with their spending. And hit a win/win/win by offering a repeatable and fast process for finance and HR teams.

While some employers still prefer the traditional paper check, 82% of employees consider digital, flexible alternatives to be a major benefit.

When it comes to employees

Equate money with security

Are confident in how they manage their money

Let’s work together to get 100% of your employees feeling confident & secure.

We also have financial literacy programs for your employees.

Help Your Business

- Get 100% electronic pay across your organization

- Guarantee new employees first pay with instant-issue cards

- Reduce payroll administration and distribution costs

- Ensure prompt disbursement and access to wages for participating employees

- Improve payroll security and control

- Deliver uninterrupted pay in the face of a disaster

Help Your Employees

- Manage finances anytime, anywhere with the Money Network Mobile App

- Gain easy access to wages on payday

- Pay for virtually anything without the need for carrying cash

- Set aside funds with the Money Network Mobile App Piggy Bank feature

- Access cash at 40,000+ surcharge-free ATMs

- Safely access and manage money without the risk of incurring non-sufficient funds (NSF fees)

- Cash Money Network Checks for free at 6,000+ participating locations

Want more info?

Interested in offering Financial Literacy Programs to your employees?

Download this brochure and learn more about Money Network today.