Value-Added Services

Enhance the level of customer service you are able to offer with a host of our value-added services, designed to add immense benefit to you and your customers.

Aadhar Enabled Payment System (AEPS)

AEPS is a bank led model which allows cash withdrawal at the point-of-sale through biometric authentication.

To complete a cash withdrawal transaction, all your customer needs to do is input their fingerprint on the biometric device, which is paired to your cash withdrawal app on your Android smart phone.

.png)

How do you benefit?

Offer your customers a safe and seamless cash withdrawal option

Hassle free convenient and secure cash withdrawal solution which does not require the customer’s card

How do your customers benefit?

01

Withdraw cash seamlessly at their local/favourite merchant establishment

02

No card or documentation required

Bharat Bill Payment System (BBPS)

BBPS is an integrated bill payment system offering interoperable and accessible bill payment service to customers through multiple payment modes, and providing instant confirmation of payment.

There are over 172+ billers available in 13 different categories including broadband post-paid, gas, loan repayment, DTH, electricity, landline post-paid, mobile post-paid, FASTag, LPG gas, water, life insurance, cable TV and health insurance.

.png)

Business Point: Merchant Portal

Fiserv – ICICI Merchant Services now gives you easy and instant access to the latest trends and analytics of your business. Business Point, our advanced merchant portal provides detailed reporting and analysis that will help you run your business better.

With Business Point – Premium Package, you gain additional and instant access to:

Your profile details

Details of your card and digital payment transactions

Advanced analytics: Spend reports, download centre and much more

With Business Point –

Elite Package, you gain additional and instant access to:

Service request dashboard on paper roll requests, terminal related queries and so on

Download statements and reports

Transactions

Pending payments

Buy Now Pay Later (BNPL)

BNPL is a type of short-term financing which allows your customers to pay a lender in instalments by the end of a stipulated time period, for their purchases at your outlet.

Merchants benefit from offering an additional type of digital payment acceptance, while customers benefit from a low-cost, transparent, and frictionless financial product that enables lightning-fast access to credit, hassle-free credit approval, disbursement, and tension-free repayment plans.

BNPL also allows customers to split their bills into parts at little to no cost.

How Do You Benefit?

Offer your customers an additional payment option (Buy Now Pay Later)

11 million active users of Buy Now Pay Later

Applicable for small ticket size (INR 500/ with to INR 20,000/-)

No additional documentation required, transaction is processed as a regular card transaction

How Do Your Customers Benefit?

01

No card or documentation required

02

Transparent & low-cost credit

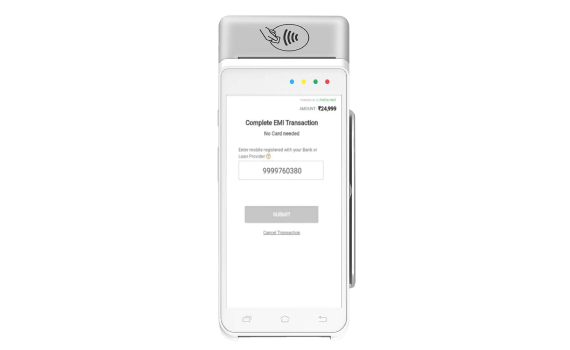

Cardless Multi Bank / Multi Lender EMI

Cardless Multi Bank/Multi Lender EMI is a hassle-free solution where you can offer cardless EMI payments to your customers.

On entering your customers registered mobile number (registered with their existing banking/lending partner), your Fiserv – ICICI Merchant Services terminal displays a list of their banking or lending partner relationships, along with the EMI repayment details (tenure and ROI). All your customer needs to do is select their preferred EMI repayment option, while you receive full payment.

Cardless EMI Can Be Offered to the Below Customers:

- Axis Bank debit card and asset linked customers

- Federal Bank debit card and asset linked customers

- HDFC Bank debit card and asset linked customers

- Home Credit

- ICICI Bank debit card and asset linked customers

- IDFC First Bank debit card and asset linked customers

- Kotak Bank debit card customers

- Many more coming soon

How Do You Benefit?

Offer your customers an additional payment option (Apart from Multi-Bank Credit Card EMI)

Hassle free convenient and secure solution which does not require customer card

No additional documentation required, transaction is processed as a regular card transaction

How Do Your Customers Benefit?

01

Purchase products/services at a tenure and ROI they are comfortable with

02

No card or documentation required

Cash@POS

Cash@POS is a unique value-added service, whereby debit card holders can withdraw cash by swiping their debit cards at your Fiserv – ICICI Merchant Services terminal(s).

How Do You Benefit?

Increase in-store sales while customers visit for cash withdrawal

Utilize cash sales toward fulfilment of cash withdrawal transactions

Generate additional revenue by offering cash withdrawal services

Reduce cost attached to handling cash

How do your customers benefit?

01

Can conveniently and securely withdraw cash from stores in their neighbourhood

02

No need to worry if closest ATM is out of service or cash

Dynamic Currency Conversion (DCC)

DCC is a secure and compliant credit card processing solution that provides merchants like you the ability to offer their international customers the choice to pay in their own currency or INR. With DCC you can accept international Mastercard and Visa cards at the point of sale in traditional face-to-face transactions while your customers enjoy the added convenience of paying in the card currency of their choice.

How Do You Benefit?

Enhanced Revenue

Gain additional income by accepting DCC payments from international customers by sharing in the foreign exchange margin normally recognised by issuers and card schemes.

Differential Offering

Increase the level of service you are able to offer with DCC payments, as over 80 percent of cardholders choose to pay in their home currency when offered.

How Do Your Customers Benefit?

01

Increased Customer Service

DCC ensures your international customers enjoy complete price transparency in a familiar currency while making a purchase. There is no additional charge for DCC transactions.

02

Customers Choice

Your international customers are given the choice to pay in their home currency with full disclosure of exchange rates and margins or in INR.

03

No Additional Cost

Your customers do not pay anything additional with DCC, as the foreign exchange margin typically applied to such transactions by schemes and foreign-issuing banks in the majority of cases will no longer apply.

ICICI Bank Debit Card EMI

ICICI Bank Debit Card EMI is your customer’s fastest way of obtaining a loan and unique opportunity to instantly upgrade or supplement their purchases in an affordable way.

With ICICI Bank Debit Card EMI, you can now offer flexible payment options for all purchases at your outlet over INR 5,000/- over 3, 6, 9 or 12 months. ICICI Bank Debit Card EMI not only increases your revenue but also enhances the level of customer service you are able to offer.

How Do You Benefit?

Additional payment option.

Likely increase in the level of customer spending.

Increase in revenue.

Enhanced customer service.

Differentiation from your competitors.

Simple setup with no new systems.

How Do Your Customers Benefit?

01

Obtain a quick loan.

02

Upgrade and supplement their purchase affordably

03

Flexible payment option for purchases over INR 5000/- (convert to EMI)

04

Options to choose EMI tenure over three, six, nine, sixteen, eighteen or thirty-six months.

Mini ATM

Mini ATM is the ideal solution for businesses that witness a high demand for cash. With Mini ATM, you have the opportunity to earn additional revenue while offering superior customer service. No need to go to the bank to deposit cash. Add ATM customers to increase footfall in shop.

How Do You Benefit?

Increase in-store sales while customers visit for cash withdrawal

How Do Your Customers Benefit?

01

Can conveniently and securely withdraw cash from stores in their neighbourhood

02

No need to worry if closest ATM is out of service or cash

Multi Bank Credit Card EMI

Multi Bank Credit Card EMI is your customer’s fastest way of obtaining a loan and unique opportunity to instantly upgrade or supplement their purchases in an affordable way.

With Multi Bank Credit Card EMI, you can now offer flexible payment options over three, six or nine months for all purchases at your outlet. Multi Bank Credit Card EMI not only increases your revenue but also enhances the level of customer service you are able to offer.

Partner banks include Axis Bank, Citibank, Federal Bank, ICICI Bank, Kotak Mahindra Bank, HSBC Bank, IndusInd Bank, RBL Bank, SBI Cards, Standard Chartered Bank and Yes Bank.

How Do You Benefit?

Additional payment option.

Likely increase in the level of customer spending.

Increase in revenue.

Enhanced customer service.

Differentiation from your competitors.

Simple setup with no new systems.

How Do Your Customers Benefit?

01

Obtain a quick loan.

02

Upgrade and supplement their purchase in an affordable manner.

03

Flexible payment option for purchases over INR 1500/- (convert to EMI).

04

Options to choose EMI tenure over three, six or nine months.

Payment Acceptance through Amazon Pay

Amazon Pay is a payment method/wallet customers can use to pay for goods and services at physical stores across the country. Thousands of customers rely on Amazon Pay for their payment needs, thus steadily building a strong customer base.

Your customers can experience a faster and convenient checkout, by simply scanning the QR code generated on their Fiserv – ICICI Merchant Services terminal or the ‘IMS Mobile (Merchant Point)’ app.

How do you benefit?

Offer your customers an additional payment option.

Faster and convenient checkout.

Simple & frictionless payment experience by scanning the QR at your establishment.

Access to the large customer base of Amazon

Earn rewards through various merchant campaigns

How do your customers benefit?

01

Benefit from huge discounts through Amazon coupons & cashback offers.

02

Make contactless payments via the Amazon app.

03

Option to choose between Wallet balance or UPI when scanned through Amazon app

Payment Acceptance through MobiKwik

MobiKwik is a payment method/wallet customers can use to pay for goods and services at physical stores across the country.

With thousands of customers shopping and making payments through MobiKwik, MobiKwik is steadily building a strong customer base. MobiKwik is fast becoming the preferred mode of payment due to its world‑class security, fraud prevention and buyer protection.

Your customers can experience a faster and convenient checkout, by simply scanning the QR code generated on your Fiserv – ICICI Merchant Services terminal.

How Do You Benefit?

Offer your customers an additional payment option

Faster and convenient checkout

Simply scan the QR code generated on your terminal

How Do Your Customers Benefit?

01

Benefit from huge discounts through MobiKwik cashback offers

02

Added convenience of another payment option.

Payment POD

With our payment POD, you will get instant voice alerts on every payment you receive from your customers, through your Fiserv – ICICI Merchant Services terminal or QR at your store front.

How do you benefit?

Instantly receive an audio payment alert through the payment POD.

Also receive a visual payment alert instantly on the payment POD screen.

Easy integration- Payment POD is equipped with a SIM card, so there is no need for Wi-Fi connection.

Manage transaction confirmation easily.

Easy to place payment POD – Comes with device stand & merchant QR code printed on it.

How do your customers benefit?

01

Can seamlessly pay with any debit or credit card on the terminal, or any UPI app of their choice by scanning the QR code.

02

Reduced wait time in checkout.

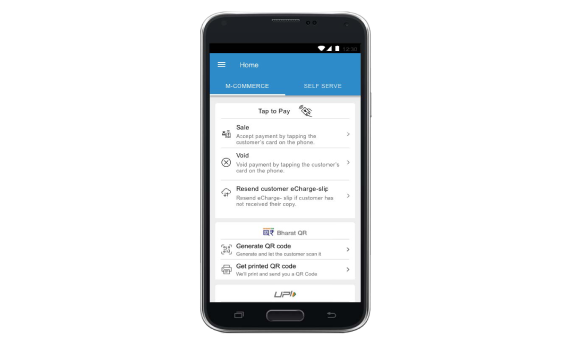

Tap to Pay

Tap to Pay is a new feature available on the ‘IMS Mobile – Merchant Point’ app, where merchants like yourself can accept card payments upto INR 5000/-, through any Near Field Communication (NFC) enabled Android smart device.

To accept card payments, all you have to do is tap and hold your customer’s contactless card on the back of your Android smart device.

How do you benefit?

Seamlessly accept card payments from all your customers with their contactless cards

Simply tap and hold the card on the back of your Android smart device to accept card payments seamlessly

All transactions are data secured per industry standards to protect personal and card information

Unified Payments Interface (UPI) and Bharat QR stand

Place the QR stand near the payment counter, so it can be easily scanned by your customers with their smartphone through their respective UPI/Bharat QR apps.

-and-Bharat-QR-stand.png)

How do you benefit?

Anytime anywhere payment acceptance

Low risk, secure transactions

Reduced inconvenience and cost of cash

Simplified payment experience for your customers

Call Us: 1800-266-6545 or 1800-102-1671

Our sales team is available to answer any of your questions.